When it comes to investing, there are countless options available. From stocks and bonds to real estate and cryptocurrencies, the choices can often feel overwhelming. However, one investment that has stood the test of time is gold. This precious metal has been valued for centuries and continues to hold a prominent place in the world of finance. But why exactly is gold such a wise investment choice? In this blog post, we'll explore the various reasons why gold should be on your radar as an investor and how you can unlock its potential today.

The Benefits of Investing in Gold: Why It's a Wise Choice

Investing in gold is a smart choice for anyone who wants to diversify their portfolio and minimize risk. Unlike stocks or bonds, gold's value isn't dependent on the performance of any one company or government entity – it's a commodity that retains its purchasing power over time.

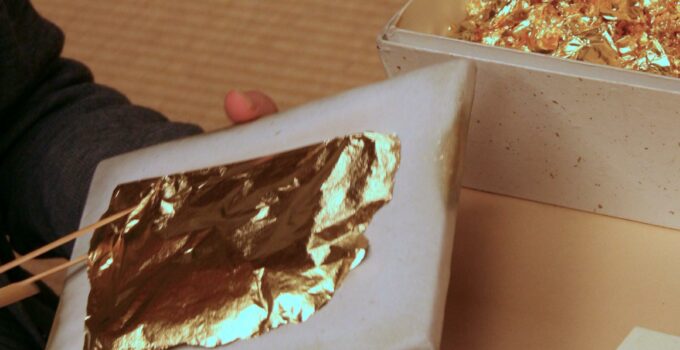

Gold has historically been used as a hedge against inflation, making it an attractive investment option during times of economic uncertainty. Additionally, gold is a tangible asset that can be held physically (in the form of coins/bars) or digitally (through exchange-traded funds), giving investors flexibility in how they choose to invest.

Overall, investing in gold provides stability and security for your financial future. With its proven track record as a store of value, now is the perfect time to consider adding this precious metal to your investment portfolio.

Factors to Consider When Investing in Gold

When considering how best to invest in gold, there are several factors that you should take into account. The first is the purpose of your investment – are you looking for a long-term store of value or hoping to profit from short-term price fluctuations? Another important consideration is the form in which you will buy gold. Gold can be purchased as physical bullion such as coins or bars, through exchange-traded funds (ETFs) or mutual funds, as well as through digital platforms like cryptocurrency. Each method has its own advantages and disadvantages depending on your personal circumstances.

Another factor to keep in mind when investing in gold is your overall portfolio diversification. While gold can offer a hedge against inflation and economic uncertainty, it should not make up the entirety of your investments. It's recommended that investors aim for between 5-10% of their portfolio to be invested in precious metals such as gold.

Finally, it's important to research reputable dealers and custodians if purchasing physical bullion or storing assets with third-party providers. These considerations will help ensure that you're making an informed decision about how best to invest in this valuable commodity.

Different Ways You Can Invest in Gold Today

One of the most common ways to invest in gold is through buying physical gold. This includes purchasing gold bars or coins from a reputable dealer, with the value typically based on the weight and purity of the metal. Another option is investing in exchange-traded funds (ETFs) that track the price of gold, which can be bought and sold like traditional stocks.

For those looking for more indirect investments, there are also options such as gold mining company stocks or mutual funds that specialize in precious metals. It's important to do thorough research and analysis before making any investment decisions to determine what method aligns with your goals.

Ultimately, how you choose to invest in gold depends on factors such as your risk tolerance, investment timeline, and overall financial situation. Consulting a trusted financial advisor can provide valuable insight into creating a well-diversified portfolio that includes this resilient asset class.

Understanding the Markets: A Guide to Gold Investment Strategies

Gold investment strategies are crucial to understand before investing in this precious metal. One of the most popular strategies is buy and hold, where investors purchase gold and hold onto it for a long period of time, usually several years or more. This strategy is based on the belief that gold will appreciate in value over time, making it a good long-term investment.

Another strategy is trading gold futures, which involves buying or selling contracts that represent a certain amount of gold at a future date. This can be a more complex strategy, as it requires knowledge of the futures market and the ability to predict future price movements.

Investors can also consider gold mining stocks as an alternative way to invest in gold. These stocks are shares in companies that mine for gold, and their value is tied to the price of gold. However, they can be riskier than investing directly in physical gold.

It's important to note that each strategy has its own set of risks and rewards, and investors should carefully consider their goals and risk tolerance before choosing a strategy. Consulting with a financial advisor can also help investors make informed decisions about their gold investments.

How to Determine the Best Time to Buy and Sell Gold

Understanding the Gold Market: Trends and Predictions

The gold market can be volatile, making it crucial to understand the current trends and predictions. Two key phrases to keep in mind when considering the best time to buy and sell gold are “price movements” and “market indicators.” By keeping an eye on these factors, you can have a better understanding of how the market is behaving and make informed decisions about when to buy or sell. Additionally, tracking global economic events can also provide insight into future price changes. Staying up-to-date on all of these factors will help you navigate the gold market with confidence and maximize your ROI potential.

Key Indicators for Timing Your Gold Purchases and Sales

Timing is everything when it comes to investing in gold. To make the most out of your investment, you need to keep an eye on the market trends and identify key indicators that signal the best time to buy or sell. One important factor to consider is the current price of gold, which can fluctuate based on global economic conditions, geopolitical events, and supply and demand. Another key indicator is the gold-to-silver ratio, which can help you determine whether gold or silver is a better investment at any given time. By staying informed and monitoring these indicators, you can make smart decisions about when to buy and sell gold for maximum ROI.

The Role of Macro-Economic Factors in Determining Gold's Value

Macro-economic factors play a crucial role in determining the value of gold, making it essential to stay updated on economic news and trends. Two important key phrases to consider when monitoring these factors are “inflation” and “market uncertainty.” Inflation can decrease the value of currency, leading investors to turn towards gold as a more stable investment choice. Similarly, market uncertainty due to geopolitical tensions or global economic concerns can cause fluctuations in stock markets, leading investors to seek refuge in gold. By staying informed about these macroeconomic factors, you can determine the best time to buy and sell gold for maximum ROI.

Expert Insights on Navigating Volatility in the Gold Market

In order to determine the best time to buy and sell gold, it's important to have a good understanding of market volatility. Keep an eye out for key economic indicators that can impact the price of gold, such as interest rates or inflation. It's also helpful to pay attention to geopolitical events and any announcements from central banks.

Expert investors suggest accumulating physical gold during times of uncertainty – this is when buying opportunities arise. On the other hand, selling some amount of your holdings at peak prices can be lucrative. Overall, it's essential that you study long-term trends while considering short-term risks when planning your investment strategy for gold trading.

ROI on Your Mind? Here's What You Need To Know Before Investing In Gold

Understanding the Fluctuations in Gold Prices: Important Factors to Consider

Investing in gold can be a lucrative opportunity, but it's important to understand the factors that affect its price. One key factor is the supply and demand of gold. When there is a high demand for gold, prices tend to rise. Conversely, when there is an oversupply of gold, prices may decrease. Another important factor is the strength of the US dollar. Since gold is priced in dollars, a weaker dollar can lead to higher gold prices. It's also important to keep an eye on global economic and political events, as they can have a significant impact on the price of gold. Keeping these factors in mind can help you make informed decisions when investing in gold.

The Role of Historical Performance in Assessing Gold as a Viable Investment Option

Historical performance is crucial when determining the potential ROI of gold investments. Over the past decade, gold has proven to be a profitable long-term investment, with an average annual return of approximately 10%. However, like any investment option, there are risks involved. It's important to remember that historical trends do not necessarily indicate future success and various factors can affect the value of gold in both positive and negative ways. To maximize your returns while minimizing risk, it's essential to properly diversify your portfolio and stay up-to-date on market trends and economic indicators such as inflation rates and currency exchange rates.

Practical Tips for Investing in Gold: How to Maximize Your Returns

When investing in gold, it's important to keep in mind that it's a long-term investment. Don't expect to get rich quick. Instead, focus on maximizing your returns over time. One way to do this is by diversifying your portfolio and investing in different types of gold, such as coins or bars. Another tip is to buy gold when the price is low and sell when it's high. This requires careful monitoring of the market and a good understanding of economic trends. Remember, investing in gold can be a smart choice for your portfolio, but it's important to do your research and make informed decisions.

Diversifying Your Portfolio with Gold Investments: Why It's a Smart Move

Diversifying Your Portfolio with Gold Investments is a prudent move for investors looking to hedge against inflation and protect their assets. Gold has proven to be a safe haven investment during market downturns, making it an attractive option for those seeking stability. Additionally, gold investments can help balance out more volatile assets such as stocks and bonds, reducing the overall risk of your portfolio. With its liquidity and ability to retain value over time, adding gold to your investment mix provides diversification that can lead to long-term growth opportunities.

Risks vs Rewards: Managing Your Portfolio with Smart Decision-Making

Managing Your Portfolio is a critical aspect of investing in gold. As with any investment, it's essential to assess the risks and rewards before making financial decisions. In terms of gold investment, market volatility can be challenging to predict, which can impact returns on your portfolio. That said, you can mitigate those risks by diversifying your investments across various types of assets.

Moreover, fluctuations in currency value influenced by global economic events also affect gold prices. It means monitoring other asset classes like stocks and bonds can help inform your decision-making process when investing in precious metals. Watch out for geopolitical tensions, inflation rates and stock market trends that could have ripple effects on the price of gold.

One way to manage risk associated with purchasing physical gold coins or bullion is through reputable dealerships who buy back their products at competitive prices; this ensures liquidity if investors need cash quickly. By being vigilant about tracking these factors impacting markets while practising sound judgement around investing principles enables investors to make smart choices for long-term growth potential within their portfolios.

In conclusion, gold is an excellent investment choice for those looking to diversify their portfolios and protect their wealth. By understanding the benefits of investing in gold, considering important factors such as market trends and the different ways to invest, you can unlock its potential even further.

As with any investment opportunity, there are inherent risks that must be managed through smart decision-making. However, when done correctly, investing in gold can provide a considerable ROI over time.

If you're ready to take the next step and start investing in this precious metal today, we invite you to visit our shop for a wide range of options that cater to your diverse needs. Whether it's bullion or numismatics you're after – we have something for everyone!

Questions

Who should invest in gold and why?

Anyone who wants to diversify their portfolio and hedge against inflation.

What are the different ways to invest in gold?

You can buy physical gold, invest in gold ETFs, or buy shares in gold mining companies.

How does investing in gold compare to other investments?

Gold has historically been a safe haven asset that can hold its value during economic downturns.

What are the risks of investing in gold?

The price of gold can be volatile and there is no guarantee of returns.

How can I ensure the authenticity of my gold investment?

Only buy from reputable dealers and verify the purity and weight of the gold.

But isn't gold just a shiny rock with no real value?

While gold has no inherent value, it has been used as a currency and store of value for thousands of years.

{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”: “Question”, “name”: “Who should invest in gold and why? “, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Anyone who wants to diversify their portfolio and hedge against inflation.”}}, {“@type”: “Question”, “name”: “What are the different ways to invest in gold? “, “acceptedAnswer”: {“@type”: “Answer”, “text”: “You can buy physical gold, invest in gold ETFs, or buy shares in gold mining companies.”}}, {“@type”: “Question”, “name”: “How does investing in gold compare to other investments? “, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Gold has historically been a safe haven asset that can hold its value during economic downturns.”}}, {“@type”: “Question”, “name”: “What are the risks of investing in gold? “, “acceptedAnswer”: {“@type”: “Answer”, “text”: “The price of gold can be volatile and there is no guarantee of returns.”}}, {“@type”: “Question”, “name”: “How can I ensure the authenticity of my gold investment? “, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Only buy from reputable dealers and verify the purity and weight of the gold.”}}, {“@type”: “Question”, “name”: “But isn't gold just a shiny rock with no real value? “, “acceptedAnswer”: {“@type”: “Answer”, “text”: “While gold has no inherent value, it has been used as a currency and store of value for thousands of years.”}}]}